placer county sales tax 2020

There is no applicable city tax. The 725 sales tax rate in Penryn consists of 6 California state sales tax 025 Placer County sales tax and 1 Special tax.

Has impacted many state nexus laws and sales tax collection requirements.

. Did South Dakota v. What is the sales tax rate in Placerville California. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Arcadia 10250 Los Angeles. Automating sales tax compliance can help your business keep compliant with changing. The Placer County sales tax rate is.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Rates Effective 07012020. The Placer County California sales tax is 725 the same as the California state sales tax.

All cashiers checks must be made payable to the Placer County Tax Collector. See how we can help improve your. The minimum combined 2021 sales tax rate for Placerville California is.

Placer County could vote on half-cent sales tax for Highway 65 improvements. Auburn Measure S. To review the rules in California visit our state-by-state guide.

While large parts of it have seen recent updates the work is far from done. By BStigers on February 29 2020. The latest sales tax rate for Roseville CA.

California City and County Sales and Use Tax Rates Rates Effective 07012020 through 09302020 1 Page Note. The Placerville sales tax rate is. One of a suite of free online calculators provided by the team at iCalculator.

The sales tax jurisdiction name is Placer County Western Slope which may refer to a local government division. You can print a 725 sales tax table here. Auburn Measure S was on the ballot as a referral in Auburn on November 3 2020.

16-02 Authority Ordinance which would impose a retail transactions and use tax to supplement local revenue for local transportation purposes and projects as authorized by section 180201 of the. Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Placer County totaling -025. All sales require full payment which includes the transfer tax and recording fee.

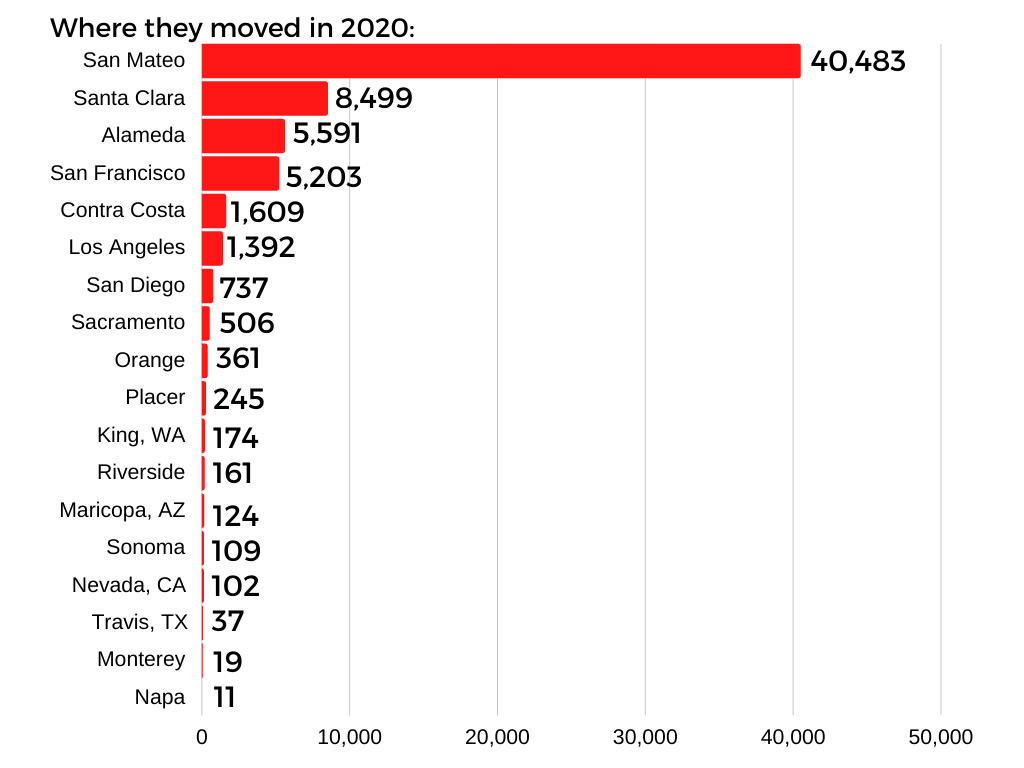

This table shows the total sales tax rates for all cities and towns in Placer. The highest number of sales tax measures 129 were on the ballot in 2020 while no sales taxes were proposed in 2010. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected.

A yes vote supported authorizing an additional sales tax of 1 for 7 years generating an estimated 256 million per year for general services. Home News Local News Sales Tax Increase For Lower Placer County Cities to Pay For Transportation. This is the total of state county and city sales tax rates.

It was defeated. The 725 sales tax rate in lincoln consists of 6 california state sales tax 025 placer county sales tax and 1 special tax. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage.

2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes. The 2018 United States Supreme Court decision in South Dakota v.

Leaders said they are about nine years. A yes vote supported authorizing an additional sales tax of 1 for 7 years generating an estimated 256 million per year for general services including law enforcement fire services and code enforcement services thereby. A capacity crowd attended a meeting at Old Town Pizza in Lincoln last night to hear officials of the Placer County Transportation Planning Agency address the projects that are in planning and or under construction stages in South.

This tax is calculated at the rate of 055 for each 500 or fractional part thereof if the purchase price exceeds 100. The Placer County Sales Tax is collected by the merchant on all qualifying sales made within Placer County. The California sales tax rate is currently.

The Placer County California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Placer County California in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Placer County California. The December 2020 total local sales tax rate was also 7250. California has a 6 sales tax and Placer County collects an additional 025 so the minimum sales tax rate in Placer County is 625 not including any city or special district taxes.

The average sales tax rate in California is 8551. No personal checks will be accepted. The Placer County Transportation Planning Agency designated and acting as the Placer County Local Transportation Authority Authority adopted Ordinance No.

The December 2020 total local sales tax rate was also 7250. The minimum combined 2021 sales tax rate for roseville california is. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to California local counties cities and special taxation districts. Placer County Sales Tax Rates for 2022. California City and County Sales and Use Tax Rates.

Next to city indicates incorporated city. The current total local sales tax rate in Placer County CA is 7250. The County sales tax rate is.

1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. You can find more tax rates and allowances for Placer County and California in the 2022 California Tax Tables. Aptos 9000 Santa Cruz Arbuckle.

Method to calculate Placer County sales tax in 2021.

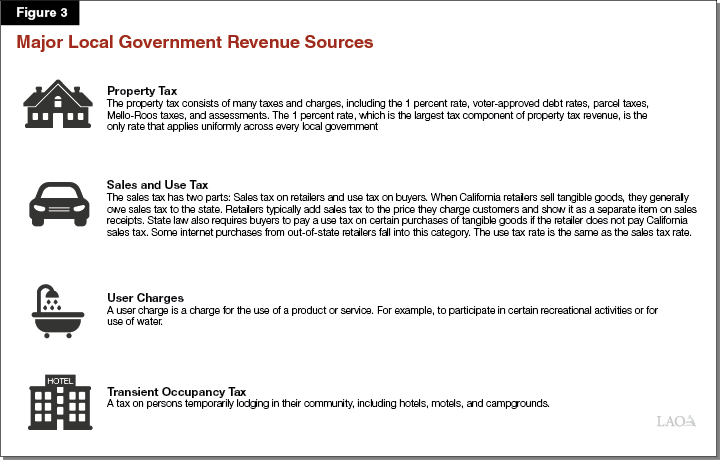

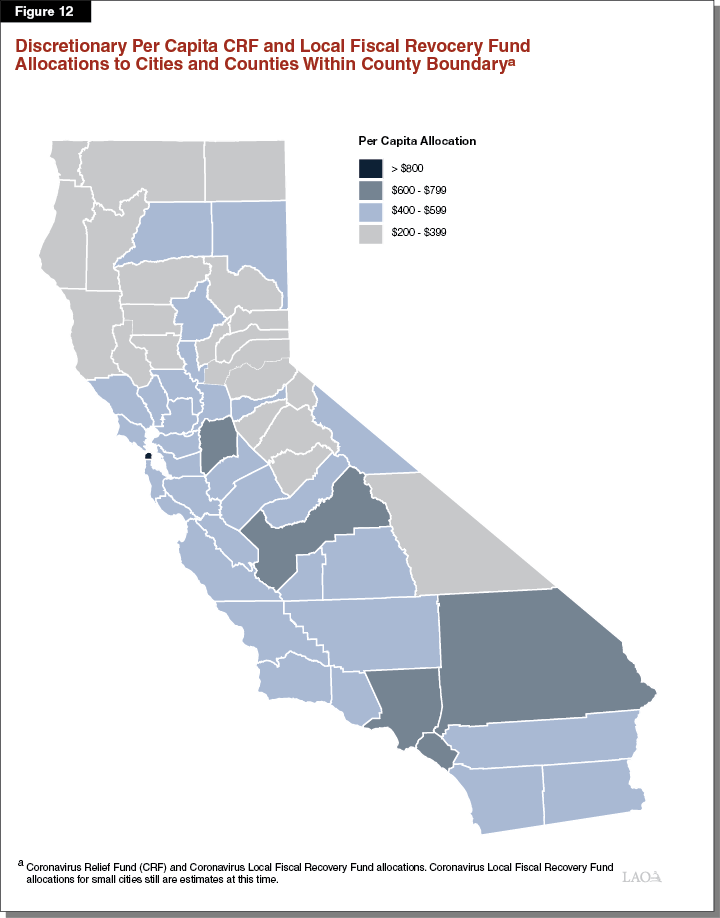

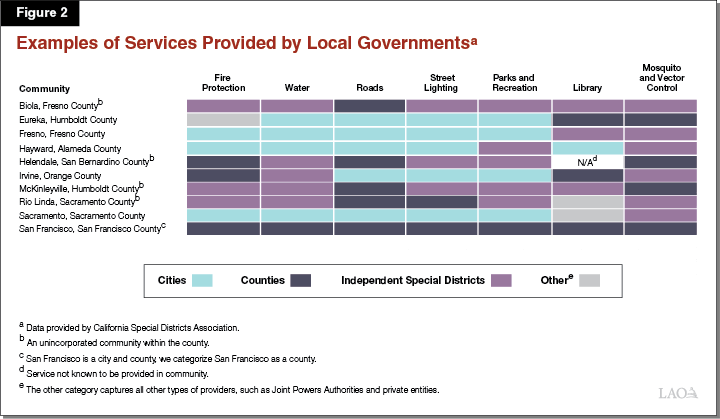

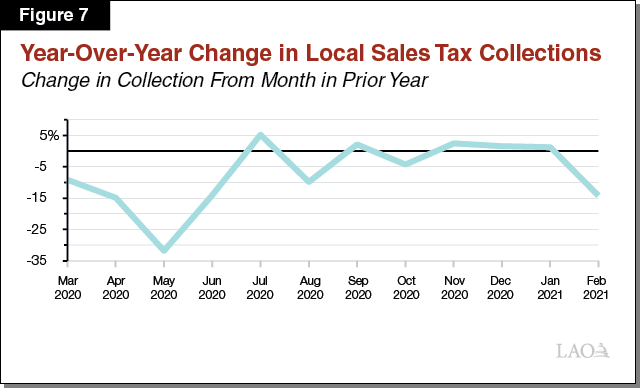

An Initial Look At Effects Of The Covid 19 Pandemic On Local Government Fiscal Condition

Who Loves Passive Income Passiveincome I Help Local Businesses And E Commerce To Generate Reve Start Online Business Personal Finance Budget Business Money

An Initial Look At Effects Of The Covid 19 Pandemic On Local Government Fiscal Condition

Click The Photo For More Info And Free Real Estate Scripts Money Management Advice Finance Investing Investing

An Initial Look At Effects Of The Covid 19 Pandemic On Local Government Fiscal Condition

New 2022 Kia Soul Gt Line For Sale In Yuba City Ca Kndj63auxn7181192

Sb1 Placer County Transportation Planning Agency Pctpa Facebook

An Initial Look At Effects Of The Covid 19 Pandemic On Local Government Fiscal Condition

Featured Archives Page 2 Of 144 Climate Online

Draft Mtp Scs Comments Received Sacog

Placer County Searches For Man Who Stole Purses From Restaurant 11alive Com

Faqs Placer County Ca Civicengage

Featured Archives Page 2 Of 144 Climate Online

How To Support A Friends Business For Free Business Advice New Business Ideas Financial Help