closed end loan disclosures

Using the first person instead of the second person in referring to the borrower. Regulation Z is structured accordingly.

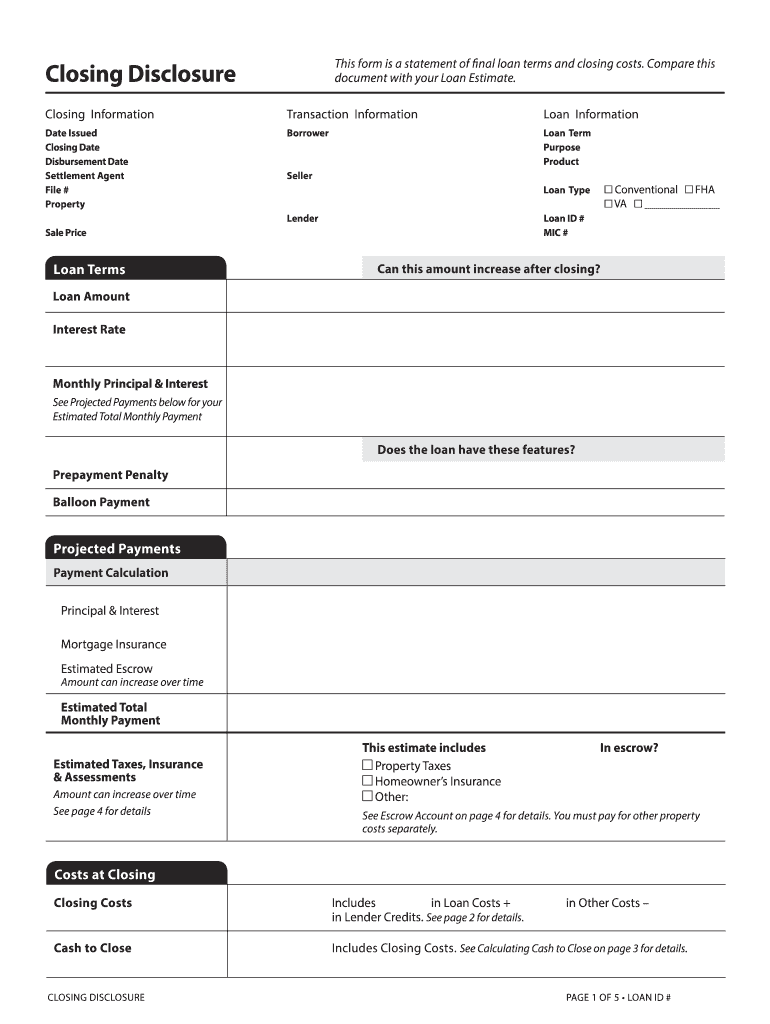

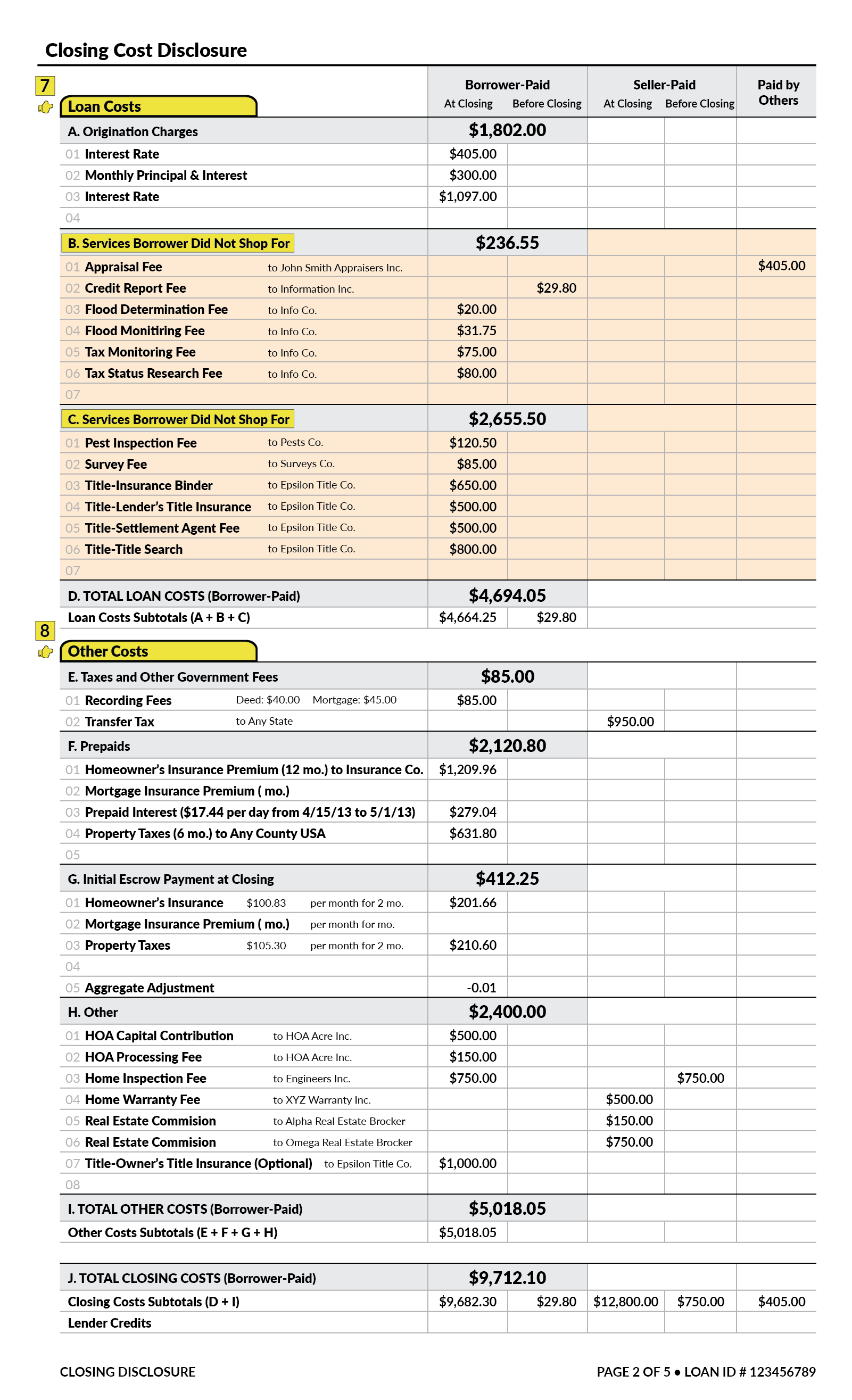

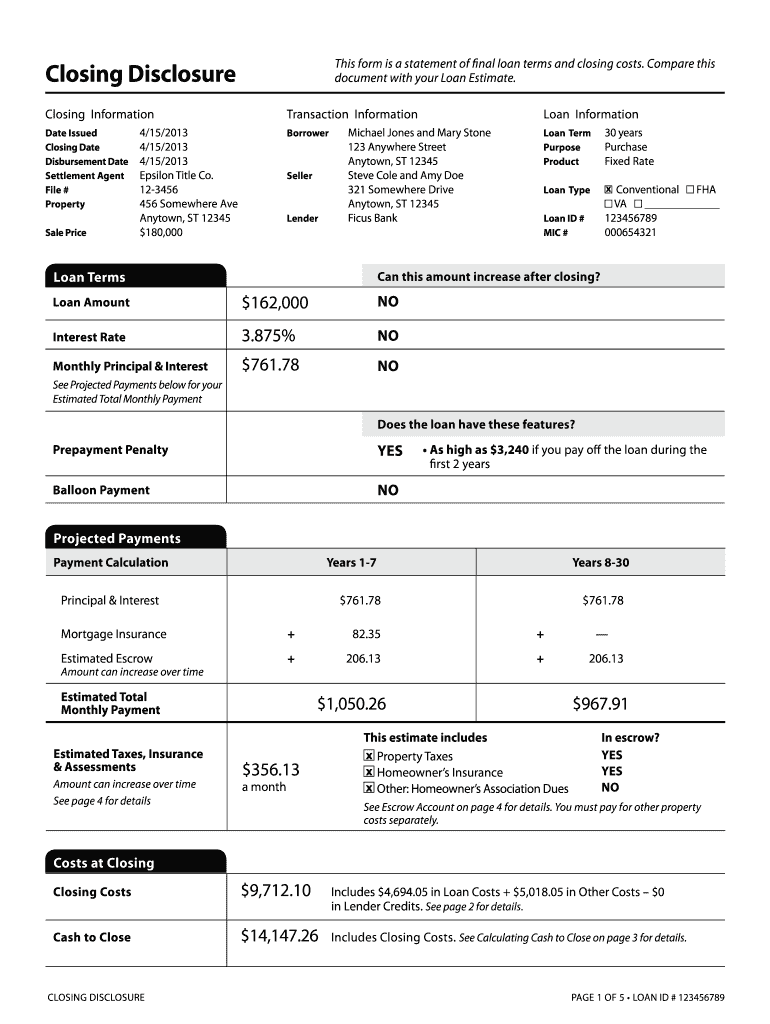

Closing Disclosure Form Fill Online Printable Fillable Blank Pdffiller

On May 7 2009 the Board adopted the MDIA Final Rule for closed-end loans secured by a dwelling.

. The TRID rule covers closed end loans secured by real. On July 23 2009 the Board issued a proposed rule to revise the rules for disclosures for closed-end credit secured by real property or a consumers dwelling. Regulation Z Reg Z requires certain disclosures be made to the member before.

The disclosure rules of Regulation Z differ depend ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages. Implementation of the Consumer Financial Protection Bureaus integrated mortgage disclosures is Aug. Home equity lines of credit reverse mortgages and mortgages secured by a mobile home or by a dwelling other than a cooperative unit that is not attached to real property ie.

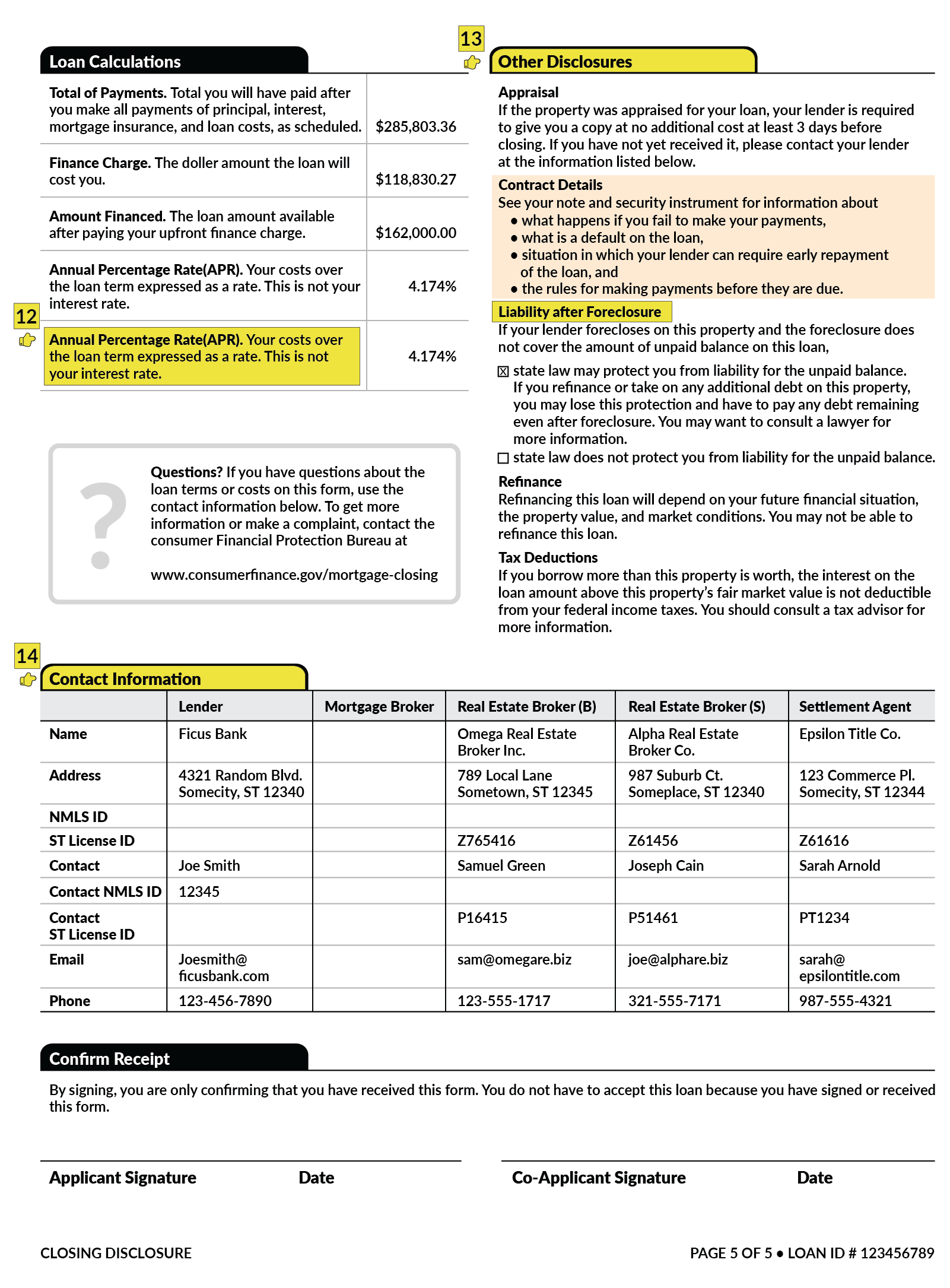

Generally the only time that new Truth in Lending Act TILA disclosures are required for closed-end loans is if a refinancing occurs. A refinancing takes place when an existing obligation is satisfied and. 2 The number of payments or period of repayment.

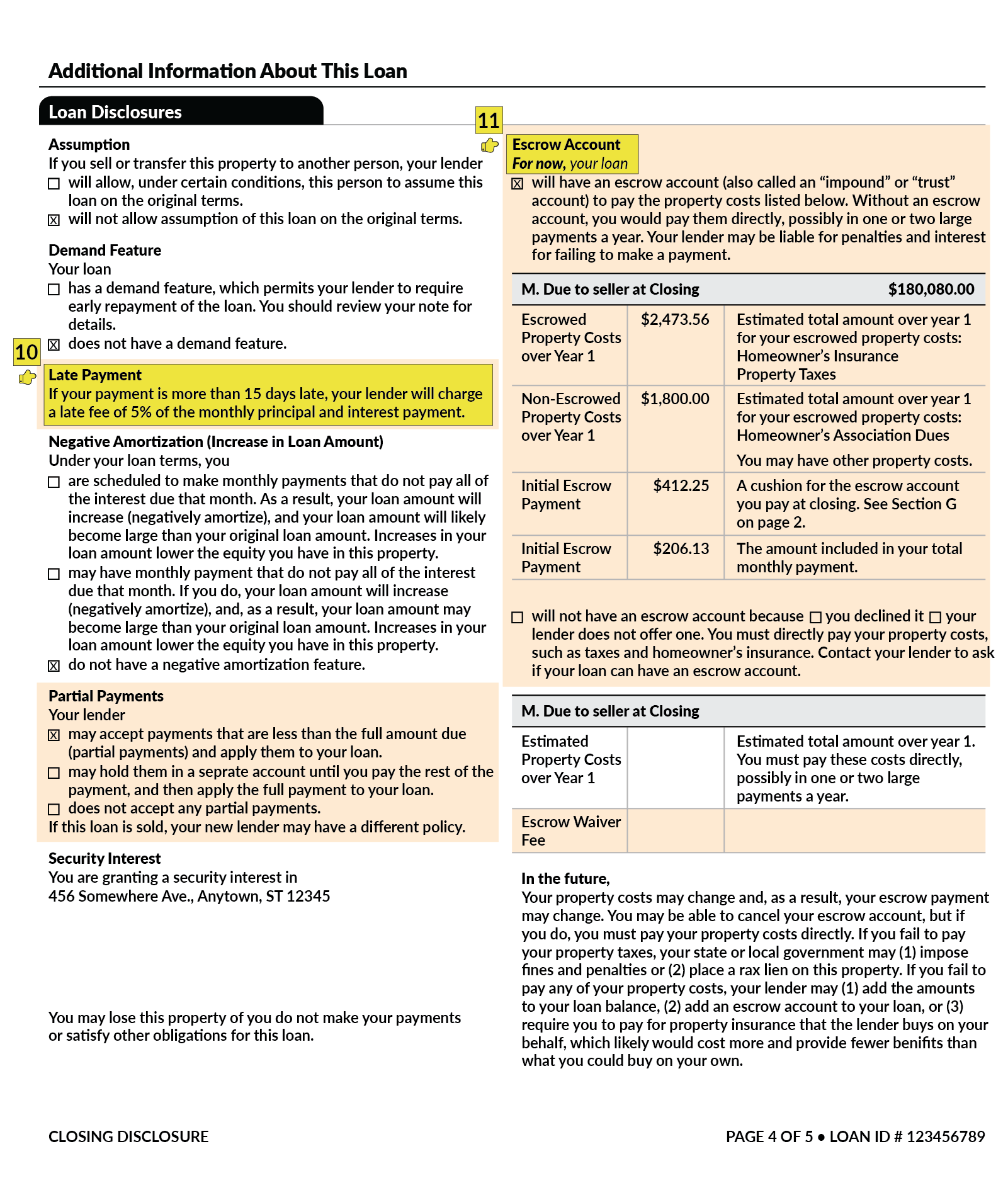

Dodd-Frank Act to integrate the mortgage disclosures under TILA and RESPA sections 4 and 5. Disclosures for mortgage loans secured a members primary residence that are subject to RESPA. H-13 Closed-End Transaction With.

Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633. Only applies to loans for the purpose of purchasing or initial construction of and secured by the consumers principal dwelling. 102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling.

74 FR 43232 Aug. The terms finance charge and except for private education loan disclosures made in compliance with 102647 annual percentage rate may be made more conspicuous in any way that highlights them in relation to the other required disclosures. 1 2015 will use the current Good Faith Estimate HUD-1 and Truth-in-Lending disclosures.

If any of the above trigger terms are present. 3 The amount of any payment. For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written application and at least seven 7 business days before consummation.

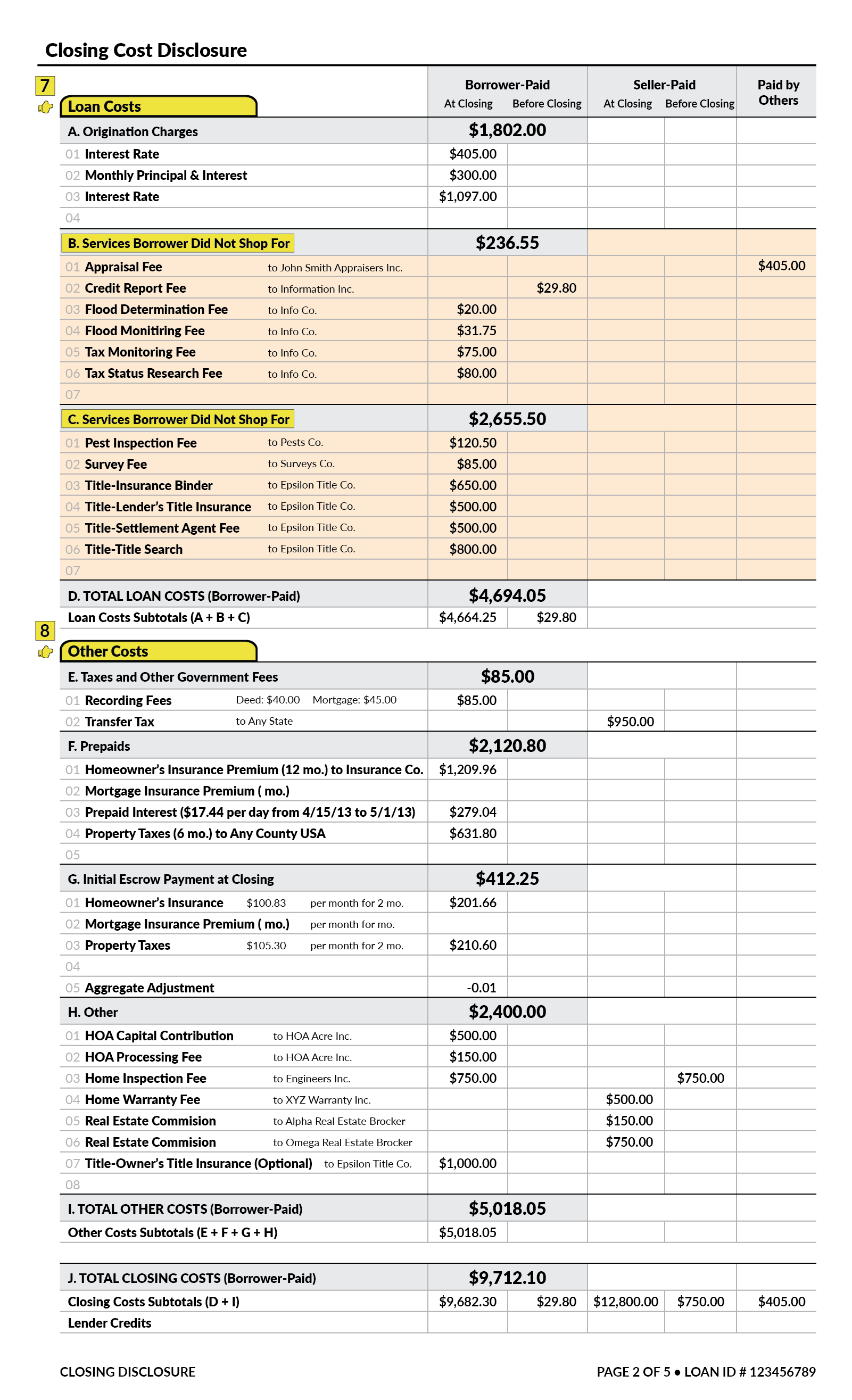

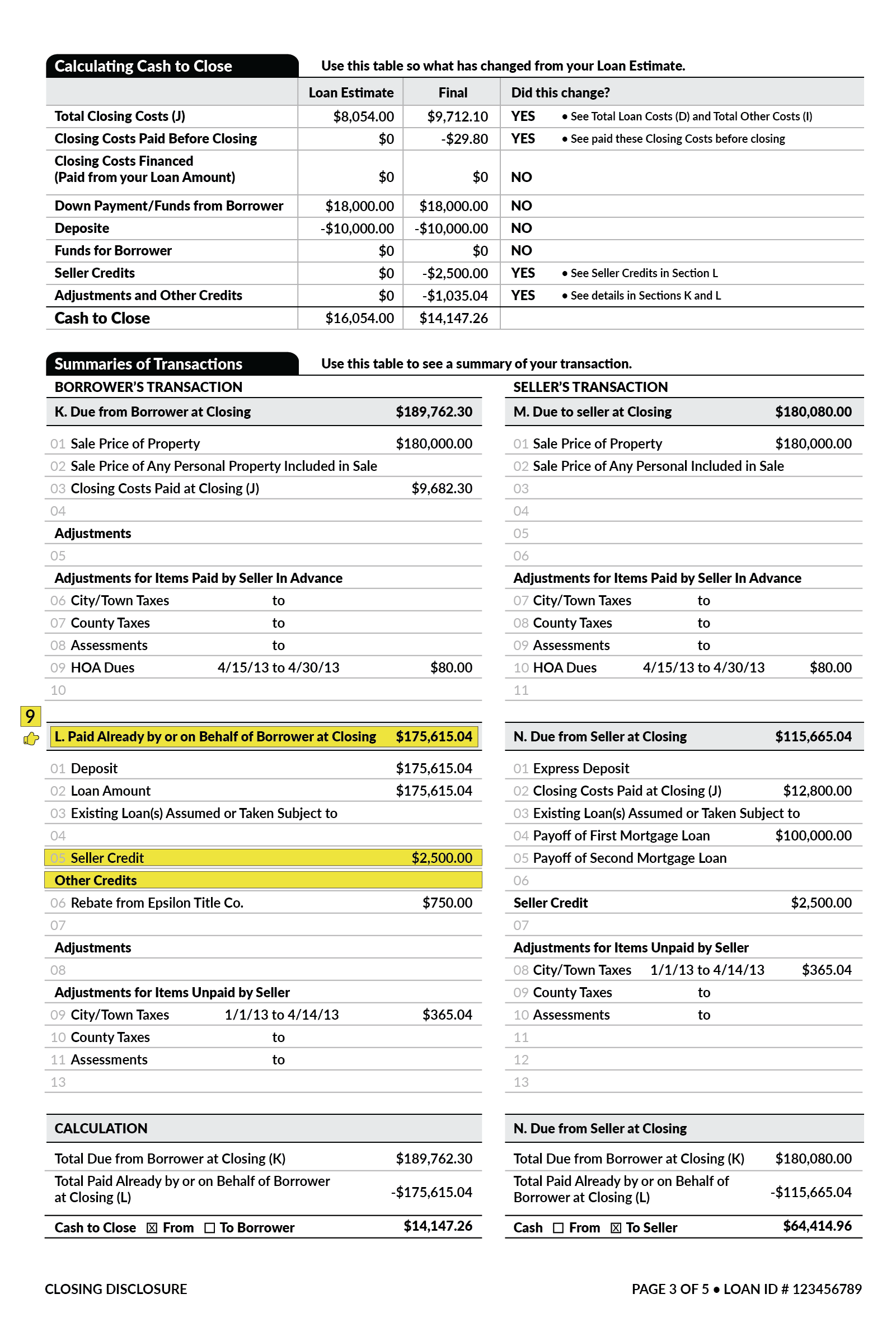

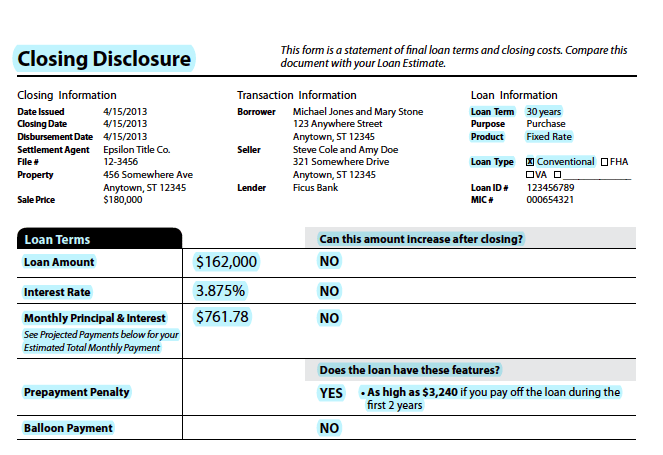

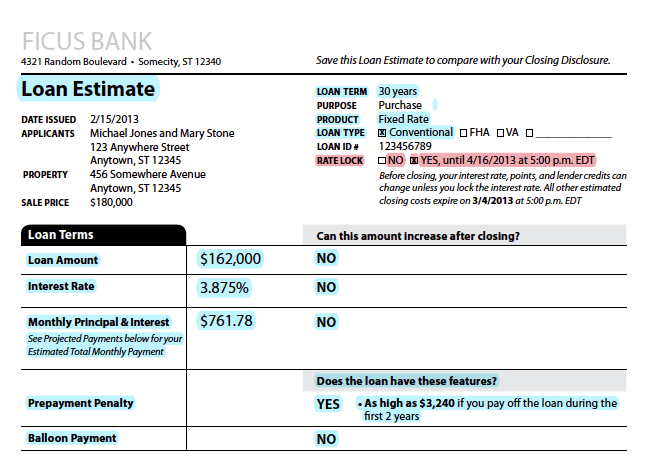

Regulation Z- Closed End Home Equity Loans Disclosure Requirements The federal Truth in Lending Act governs all consumer credit transactions. Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers Updated January 2014 Prepared by Marjorie A. The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages secured by real property or a cooperative unit.

26 2009 2009 Closed-End Proposal. Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 opens new window are subject to the disclosure timing and other requirements under the TILA-RESPA Integrated Disclosure rule TRID. Loan Program Disclosures Cite.

Subpart AProvides general information that applies to both open-end and closed-end credit. For closed end dwelling-secured loans subject to. For disclosures with respect to private education loan disclosures see comment 47b1-2.

The creditor must provide a set of closed-end credit disclosures before consummation of. Closed-End Credit Disclosure Forms Review Procedures. Only applies to purchase-money loans subject to RESPA.

This type of mortgage makes sense for. Depends on lien position. This is a model of the statement required by 102619 e 2 ii to be stated at the top of the front of the first page of a written estimate of terms or costs specific to a consumer that is provided to a consumer before the consumer receives the disclosures required under 102619 e 1 i.

A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. The Board also issued a proposed. 102637 Content of disclosures for certain mortgage transactions Loan Estimate.

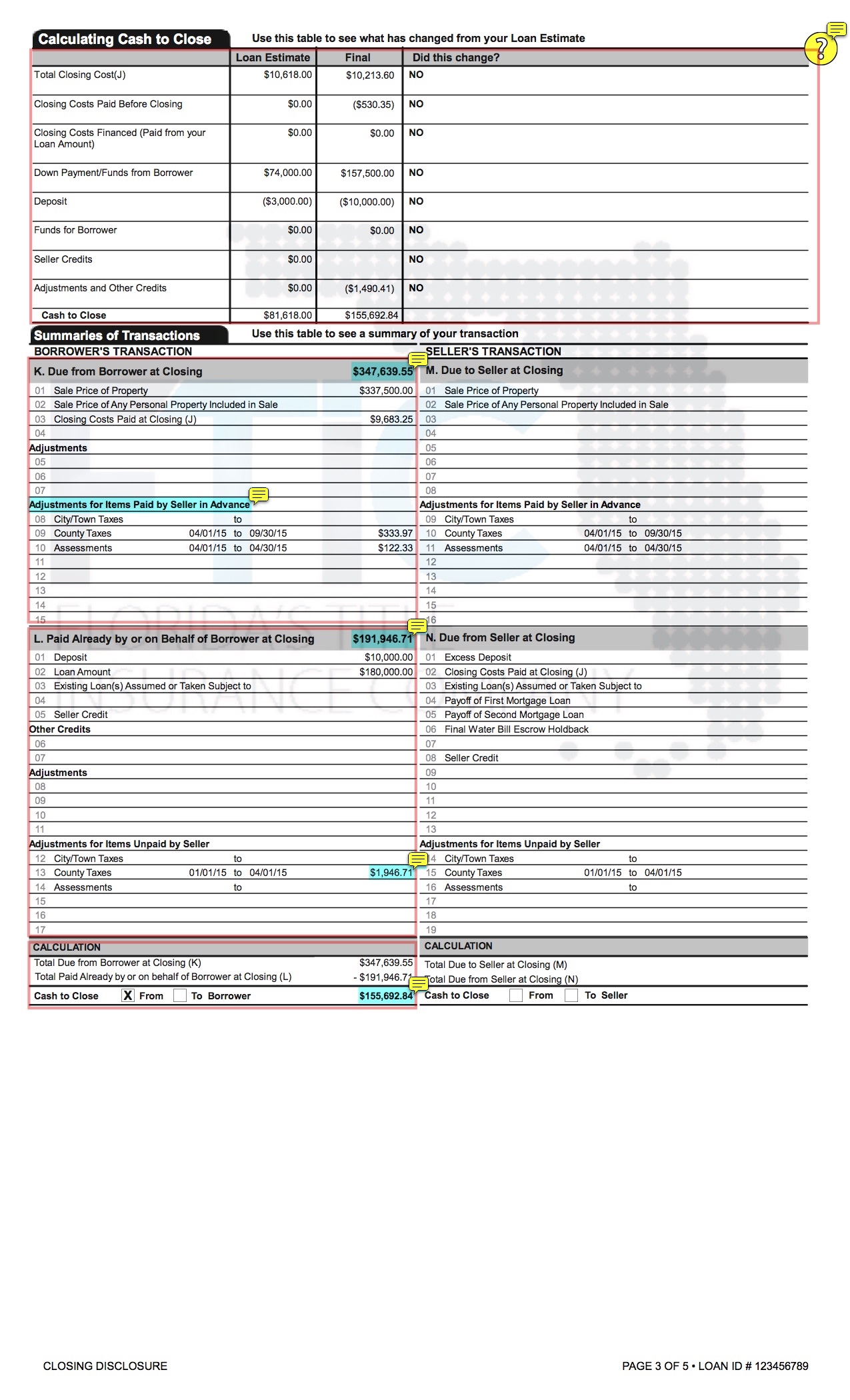

Good Faith Estimate of Settlement Costs. If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance with 102637c and. Such disclosures shall be provided by the lending institution to the person who is to be primarily liable on the loan prior to.

Thus for most. Of the disclosures you list here would be the status in a closed-end home equity loan. All disclosures required under this Part are to be made in a single separate document in plain language and with captioned subdivisions for the information to be disclosed.

Private education loan disclosures 102647 Closed-End Credit Disclosure Forms Review Procedures. 102638 Content of disclosures for certain mortgage transactions Closing Disclosure. 1 The amount or percentage of any downpayment.

All mortgage applications prior to Aug. Trigger terms when advertising a closed-end loan include. 102635 Requirements for higher-priced mortgage loans.

4 The amount of any finance charge. Combining the disclosure of loan term and payment deferral options required in 102647a3 with the disclosure of cost estimates required in 102647a4 in the same chart or table See comment 47a3-4 G. Stating No downpayment does not trigger additional disclosures.

When an open-end account converts to a closed-end adjustable-rate mortgage the 102620c disclosure is not required until the implementation of an interest rate adjustment post-conversion that results in a corresponding payment change. 22619a1 and 22619a2 10. The Loan Estimate is provided within three business days from application and the.

Closed-End Loan Disclosures for Skip a Payment Regulation Z does not require subsequent disclosures for skip payments on closed-end loans. These types of loans are often referred to as second mortgage loans even though they may not be in second lien position. A good faith estimate of expected closing costs such as loan origination fee loan discount appraisal fee assumption fee interest on per-day basis.

In a closed-end consumer credit transaction secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 the creditor shall provide the consumer with good faith estimates of the disclosures in 102637. Note that there is no stagger in the roll out. Regulation Z now contains two new forms required for most closed-end consumer mortgage loans.

They may decide among themselves which of them will provide the required disclosures.

What Is A Closing Disclosure Lendingtree

New Mortgage Documents What Are They

Understanding Finance Charges For Closed End Credit

How The Trid Closing Disclosure Delivery Period Works Myticor

What To Know About The Loan Estimate Closing Disclosure Cd

What Is A Closing Disclosure Lendingtree

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Fdic Fdic Consumer News Fall 2015 Sample Disclosures Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

What Is A Closing Disclosure Lendingtree

What To Know About The Loan Estimate Closing Disclosure Cd

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

What Is A Closing Disclosure Lendingtree

Closing Disclosure Form Excel Fill Online Printable Fillable Blank Pdffiller

What Is A Closing Disclosure Lendingtree

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau